Biden's Proposed Capital Gains Tax Hike

Impactful Storytelling

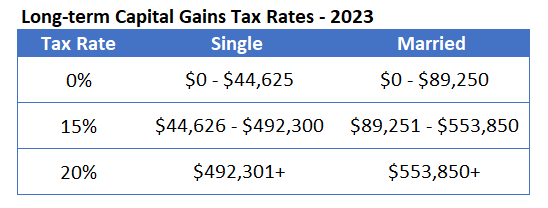

In his Fiscal Year 2025 budget proposal, President Biden has proposed nearly doubling the capital gains tax rate to 39.6%. This proposed increase would apply to investors with incomes over $1 million. The current capital gains tax rate is 20% for most assets held for more than a year. This proposed change would significantly impact investors, particularly those who hold assets for the long term.

Long-Term vs. Short-Term Capital Gains

Currently, long-term capital gains are taxed at lower rates than ordinary income, while short-term capital gains are taxed as ordinary income. The proposed change would increase the capital gains tax rate for long-term capital gains to 39.6%, which is the same rate as ordinary income for high-income taxpayers.

Comments